The Nashville Market Is At A Crossroads [February 2025 Market Update]

by Tyler Forte

February Market Stats

February Key Takeaways

📈 - Inventory is rising, but demand remains steady – The number of homes for sale is 16% higher than last year, giving buyers more choices. However, demand has stabilized, with 678 homes going under contract, slightly up from 2024 but still below 2023 levels.

🏠 - Home prices are still increasing, but growth has slowed – The median home price is now $510,000, up only 2.5% from last year, compared to an 8.7% increase the year before. This suggests that price growth is cooling, but homes aren’t getting cheaper.

🤝 - Affordability is a major challenge – Mortgage rates are hovering around 6.84%, keeping monthly payments high. Compared to 2023, buyers are now paying $400 more per month for a typical home. Until rates drop or incomes rise, affordability will remain tight.

👀 - The market is shifting toward balance – Months of supply has increased to 5.1 months, meaning the extreme seller’s market of the past few years is fading. Buyers have more leverage, but we’re not in a full buyer’s market yet. Well-priced homes still sell, but sellers need to be realistic and flexible.

February In-Depth Analysis

If you’ve been following the real estate market in Nashville, you probably have one big question in mind: is now a good time to buy or sell?

Well, the numbers are in, and we’ve got some interesting trends to talk about.

Supply-Side:

Let’s start with the supply side of things. New listings in February 2025 came in at 1,014, which is 15% lower than February 2024 but still slightly above 2023 levels.

This suggests that sellers may be holding back compared to last year, possibly because mortgage rates remain high and some homeowners feel stuck in place with their existing low-rate loans.

Looking at the bigger picture, the total number of homes listed since the start of the year is 2,148, which is almost identical to the 2,111 listings we saw at this time in 2023 but below the 2,336 listings that kicked off 2024.

This tells us that last year, sellers were eager to list their homes early, but in 2025, that enthusiasm has cooled.

Total inventory has also been on the rise. In February 2023, the market had 2,707 active listings. By February 2024, that number was nearly the same at 2,689. Fast forward to 2025, and total inventory has jumped to 3,120 homes. That’s a significant 16% increase in just one year.

More inventory means more choices for buyers, which is a shift away from the ultra-competitive conditions we saw in the past few years. (See chart below).

Demand-Side:

Now, let’s talk demand. The number of homes that went under contract in February tells us how active buyers are.

Back in February 2023, 704 homes went under contract. In 2024, that number dropped to 655, showing a decline in buyer activity. In February 2025, we saw a slight rebound with 678 homes going under contract, indicating that while the market isn’t as hot as it once was, it’s stabilizing.

This small uptick suggests that we could see stronger sales in March and April as these homes close. (See chart below).

Speaking of closings, 540 homes sold in February 2025, which is slightly lower than the 564 closings in February 2024 and 550 in February 2023 (See chart below).

The dip in sales this year likely reflects the ongoing affordability challenges caused by high mortgage rates.

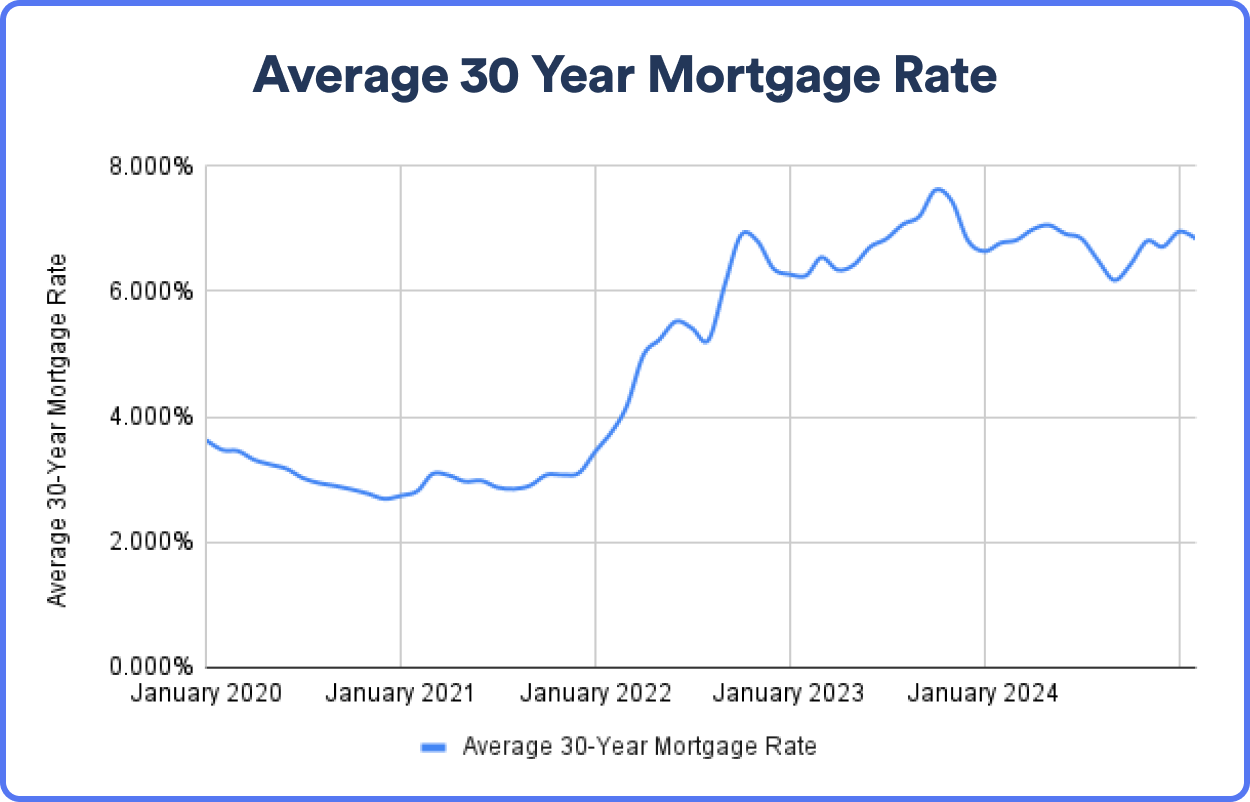

In early 2023, 30-year mortgage rates averaged 6.3%. By early 2024, they had climbed to 6.8%, and in 2025, they’re still hovering around 6.84%. These high borrowing costs are keeping some buyers on the sidelines, leading to fewer overall transactions (See chart below).

Supply vs Demand:

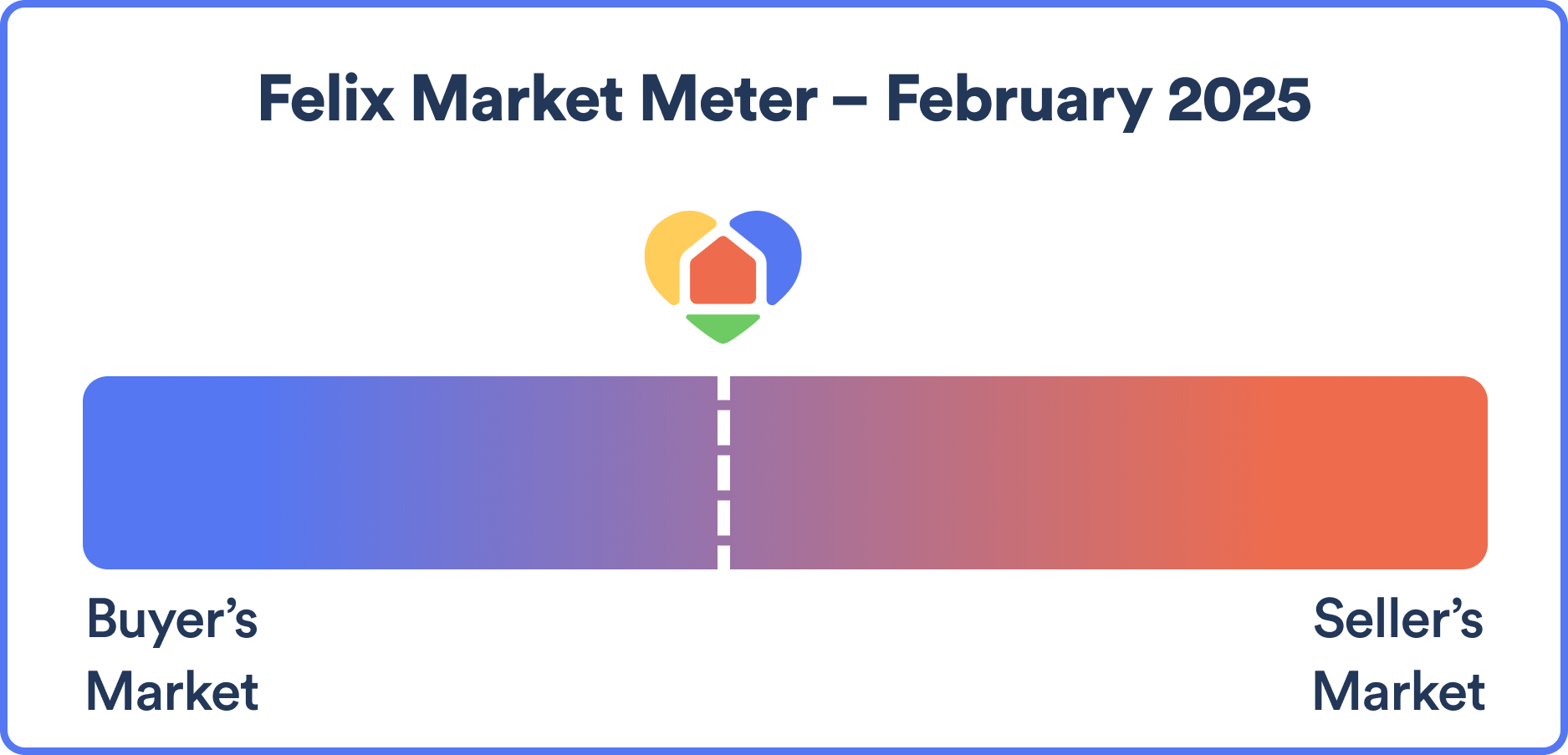

With supply rising and demand staying somewhat flat, the big question is whether Nashville is shifting toward a buyer’s market.

Traditionally, if inventory sits below six months’ worth of supply, sellers still have the upper hand.

In February 2023 and 2024, months of supply was hovering around 3.8 to 4 months, meaning it was still a strong seller’s market.

By February 2025, however, months of supply jumped to 5.1 months, inching closer to the neutral territory where neither buyers nor sellers dominate. If this trend continues and we cross the six-month mark, buyers will have even more leverage in negotiations. (See chart below).

Another factor that points to a shifting market is how long homes are sitting before selling.

In 2023, the average days on market for sold homes was 38 days, and in 2024, that number dipped slightly to 34 days. Now, in 2025, we’re back to 38 days on market, meaning homes are taking longer to sell again.

This signals that buyers have more options and are taking their time before making an offer, which is a big change from the frenzied, multiple-offer situations we saw a few years ago.

Home Prices:

When it comes to pricing, home values have continued to creep up, but at a much slower pace than before.

The median home price in February 2023 was $457,700. By February 2024, it had risen to $497,450, marking an 8.7% increase year over year. In 2025, the median price has nudged up slightly to $510,000, which is only a 2.5% increase from the previous year.

This cooling in price growth reflects a market that’s becoming more balanced. Sellers can still command high prices, but they’re no longer seeing massive year-over-year gains.

The average sale price follows a similar trend, rising from $632,516 in 2023 to $678,801 in 2024, and now sitting at $695,248 in 2025.

Mortgage Rates:

If you’re wondering where mortgage rates are headed, most experts predict that they’ll start to ease later in 2025.

While we’re not expecting to see the ultra-low 3% rates of 2021 again anytime soon, we could see rates dip below 6.5% by mid-2025 and possibly under 6% by the end of the year.

That would provide some much-needed relief for buyers struggling with affordability.

Affordability Check-In:

Speaking of affordability, things have gotten tougher over the past two years.

Back in February 2023, with a median home price of $457,700 and a 6.3% interest rate, the typical monthly mortgage payment (assuming 20% down) was $2,257.

In February 2024, with a higher home price and a 6.8% rate, the payment jumped to $2,589.

Now, in February 2025, with rates still at 6.84% and prices hovering around $510,000, that monthly payment is $2,671. That’s $400 more per month compared to early 2023.

Unless mortgage rates drop significantly or wages rise, home affordability will remain a challenge.

For buyers, 2025 presents more opportunities than the past few years. Inventory is up, homes are sitting longer, and there’s less competition than in the peak frenzy of 2021 and 2022.

If you’re thinking about buying, keep an eye on mortgage rates, as even a small drop could make a big difference in your monthly payment.

For sellers, homes are still selling, but pricing competitively is more important than ever. Overpricing a home in this shifting market could lead to longer days on market and price reductions down the road. Sellers who are willing to negotiate and offer incentives like closing cost assistance or rate buy-downs will likely have an easier time attracting buyers.

Overall, Nashville’s housing market in early 2025 is at a crossroads. It’s no longer the extreme seller’s market of 2021-2022, but it’s not a full-blown buyer’s market yet either. It’s a more balanced market, which means both buyers and sellers will need to adjust their strategies to get the best deal possible.

About Felix Homes

Felix Homes is where five-star service meets low commissions! To date, we've saved our clients $1,671,026 in commission fees and have earned 125 five-star reviews on Google!

How are we able to offer five-star service AND lower commission fees? It's simple:

- We're an independently owned brokerage – not a franchise which allows us to keep more of the commission we earn.

- By offering a lower commission, more folks want to work with us which means we close more deals. By closing more deals, we can pass more savings along to our customers!

Still not convinced? Read all about our low-commission mission here.

If you have any questions about the state of the market or the home buying/selling process, please feel free to contact us at contact@felixhomes.com or 615-354-5731.

![Nashville's Real Estate Market Is In A Balancing Act [January 2025 Market Update] Photo](https://felix-homes-assets.s3.us-east-2.amazonaws.com/thumbnail_Jan_0_50a9b1c12e.png)

![Ending The Year Strong! [December 2024 Market Update] Photo](https://felix-homes-assets.s3.us-east-2.amazonaws.com/thumbnail_December_2024_Market_Update_0_242502dfa3.png)